Oklahoma City

Market

Market Profile:

The greater Oklahoma City area presents a strong case for cash-flowing residential real estate investment for several key reasons:

1. Affordable Entry Prices

- Low cost of acquisition relative to national averages allows investors to purchase rental properties with less capital.

- Median home prices in OKC are significantly lower than in many other U.S. metro areas, enabling better cash-on-cash returns.

2. Strong Rental Yields

- Favorable rent-to-price ratios often exceed 1%, which is attractive for cash flow investors.

- High rental demand in certain submarkets, such as Edmond, Moore, and Midwest City, supports consistent rental income.

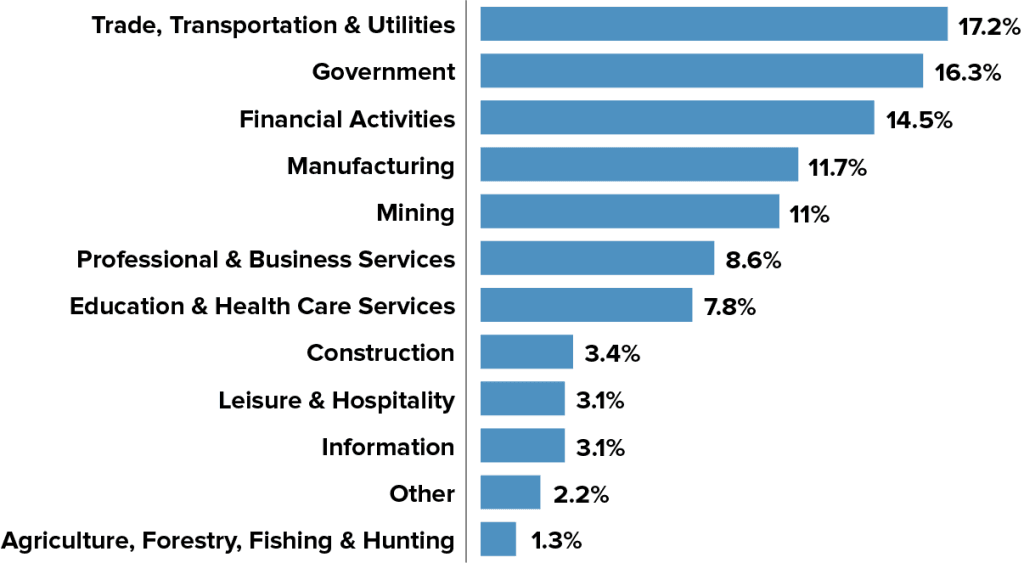

3. Growing and Diverse Economy

- The local economy is supported by industries including aerospace, energy, health care, and logistics.

- While once oil-dependent, OKC has diversified economically, reducing risk tied to commodity cycles.

4. Population Growth and In-Migration

- The metro area’s population has grown steadily over the past decade.

- In-migration from more expensive states (e.g., California, Texas) is increasing demand for affordable housing.

5. Landlord-Friendly Laws

- Oklahoma is known for landlord-friendly eviction processes and legal systems, making property management more predictable.

6. Low Property Taxes and Insurance

- Oklahoma’s property taxes are generally lower than in high-cost states, which helps reduce operating expenses and boosts net income.

7. Opportunity Zones and Appreciation Potential

- Certain parts of the city are designated Opportunity Zones, potentially offering long-term tax incentives.

- While OKC is more of a cash-flow market than an appreciation one, some neighborhoods are seeing revitalization and development that hint at future equity growth.

8. Infrastructure and Development

- Ongoing investment in infrastructure, education (e.g., MAPS projects), and public amenities is making the area more attractive to both renters and homeowners.

If you’re seeking turnkey single-family rentals, OKC’s blend of affordability, yield, and stability offers a compelling value proposition compared to overheated or coastal markets.

Population: ~694,800

Metro Size: 1,441,695

GDP Per Capita: $51,957

Cost of Living: Generally below U.S. average

Area: 621.96 square miles

Elevation: 1,198 ft

Region: The South

Time Zone: Central (UTC-6/CST, UTC-5/CDT)

Resources

Map:

Economy: