Tulsa, Oklahoma

Market

Market Profile:

The greater Tulsa, Oklahoma area offers a strong opportunity for investing in cash-flowing residential real estate. Here’s why investors are drawn to Tulsa:

1. Affordable Housing Prices

- Tulsa has low entry prices, often below the national average, making it easier to acquire properties that cash flow immediately.

- Many investors can find properties under $150,000 with monthly rents exceeding 1% of the purchase price—ideal for cash flow.

2. Strong Rent-to-Price Ratios

- Tulsa’s rent-to-value ratios are favorable for buy-and-hold investors, especially in stable working-class neighborhoods.

- Properties in areas like Broken Arrow, Jenks, and Midtown offer reliable rental demand and above-average yields.

3. Stable, Diversified Economy

- While historically tied to oil and gas, Tulsa has diversified into aerospace, health care, manufacturing, and tech.

- Major employers like American Airlines, Saint Francis Health System, and ONEOK create consistent demand for housing.

4. Landlord-Friendly Legislation

- Oklahoma’s pro-landlord laws extend to Tulsa, allowing for relatively fast and inexpensive evictions and fewer regulatory hurdles than in tenant-friendly states.

5. Low Operating Costs

- Property taxes, insurance, and maintenance costs are relatively low, boosting net operating income and long-term profitability.

6. Growing Population and Redevelopment Initiatives

- Tulsa has seen steady population growth and in-migration, particularly of remote workers attracted by affordability and quality of life.

- The Tulsa Remote program offers incentives to remote workers, driving demand for rentals in central and walkable areas.

7. Revitalization and Urban Investment

- The city has heavily invested in improving public spaces and downtown infrastructure—e.g., the Gathering Place, a nationally recognized park.

- Revitalized areas like Kendall-Whittier and Pearl District are drawing new residents and small businesses, hinting at appreciation potential.

8. Cash Flow + Moderate Appreciation

- Tulsa is primarily a cash-flow market, but select submarkets show signs of modest but steady appreciation—ideal for long-term wealth building.

In short, Tulsa combines low cost of entry, reliable rental demand, and landlord-friendly policies, making it an ideal market for investors focused on steady monthly income and potential long-term gains.

Population: More than 1,000,000

Metro Size: 420,000

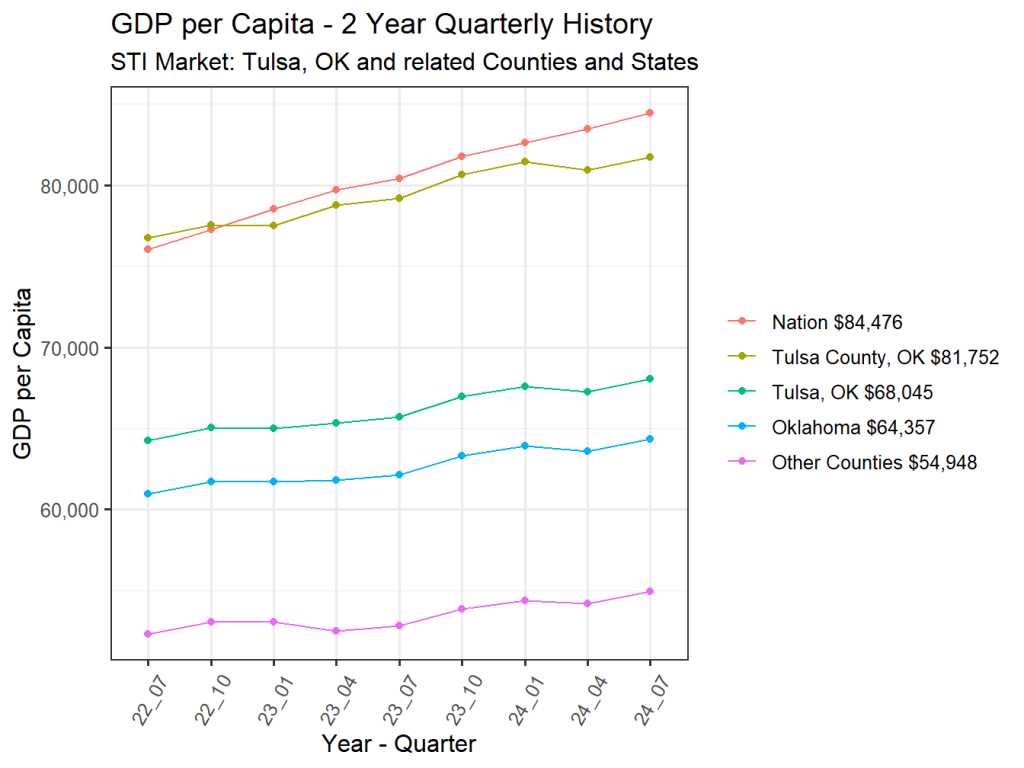

GDP Per Capita: $55,436

Cost of Living: Family of four: $4,190/month

Area: 113.85 square miles

Elevation: 201.85 sq mi

Region: The South

Time Zone: Central (UTC-6/CST, UTC-5/CDT)

Resources

Map:

Economy: